Us bank home equity line of credit calculator

Card in conjunction with a US. Home Equity Line of Credit The Annual Percentage Rate APR is variable and is based upon an index plus a margin.

How To Use Home Equity Line Of Credit U S Bank

Subject to credit approval.

. A HELOC often has a lower interest rate than some other common types of loans and the interest may be tax deductible. Home Equity Line of Credit. You can then use your new US.

Obtaining the best rate also requires the following criteria to be met. To Apply Now or Schedule an Appointment. As of July 28 2022 An early closure fee of 1 of the original line amount maximum 500 will apply if the line is paid off and closed within the first 30 months.

The APR will vary with Prime Rate the index as published in the Wall Street Journal. And are only available for properties located in the US. Mortgage and home equity products are offered in the US.

You can utilize all or a portion of the total credit limit as you need it and only pay interest on the amount you use. HELOCs have a 10-year draw. Home Equity Line of Credit The Annual Percentage Rate APR is variable and is based upon an index plus a margin.

CLTV is your overall mortgage loan debt expressed as a percentage of your homes fair market value. The APR on your home equity line of credit is variable based upon the Wall Street Journal Prime Rate plus a margin. Simply access cash as you need it using checks or a Home Equity Access Card.

1 A new home equity line of credit application 2 A line amount of 200000 or more 3 Line must be in first lien position 4 Having a Citizens consumer checking account set up with automatic monthly payment deduction at the time of origination 5 A loan-to-value LTV of 80 or less 85 or less in Michigan and. How can I use a home equity line of credit. As of July 28 2022 An early closure fee of 1 of the original line amount maximum 500 will apply if the line is paid off and closed within the first 30 months.

To qualify for a home equity line of credit is largely the same process as qualifying for a mortgage. The home equity line of credit calculator automatically displays lines corresponding to ratios of 80 90 and 100. The APR will vary with Prime Rate the index as published in the Wall Street Journal.

Line amounts from 10000 to 1000000. With a Home Equity Line of Credit you will choose if you want to make Interest-Only or Principal and Interest payments during the 10-year Draw Period when you have access to your line of credit up to your available credit limit. Youre given a line of credit thats available for a set time frame usually up to 10 years.

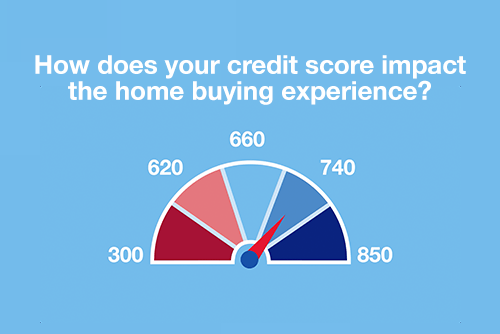

As you pay down your mortgage andor your home appreciates in value your equity grows. It acts as a revolving line of credit similar to a credit card and a high utilization rate can negatively impact your credit score. Home equity is the current value of your home minus your outstanding mortgage balance.

For line amounts greater than 500000 maximum combined loan-to-value ratios are lower and certain restrictions apply. You may not use this home equity line as a bridge loan for commercial purposes to invest in securities or to repay a margin loan. For Texas primary residences we will lend up to 80 of the total equity in your home and your line of credit amount cannot exceed 80 of the homes value.

A home equity line of credit also known as a HELOC is a line of credit secured by your home that gives you a revolving credit line to use for large expenses or to consolidate higher-interest rate debt on other loans Footnote 1 such as credit cards. Loan line of credit or mortgage 8 Legal Disclaimer opens in popup in the future. One downside of a home equity line of credit.

A home equity line of credit or HELOC is a type of home equity loan that works like a credit card. The maximum line amount is 1 million. By HSBC Bank USA NA.

It can also display one additional line based on any value you wish to enter. This election of Interest-Only or Principal and Interest payments may be changed every 12 months. You can tap into this equity in a few ways and finance other goals or purchases you may have.

Applying for a HELOC could potentially affect your credit score. For example if your lender will allow a 95 ratio the calculator can draw that line for you in addition to the other three. Why Use Your Home Equity.

We use your Canadian credit history when considering your credit card application. The maximum APR that can apply is 18 or the maximum amount permitted by state law. Programs are subject to change.

100 Bank-Paid Closing Costs Options Available. Bank of Americas HELOC has a minimum credit line amount of 15000 in some locations but the minimum is generally 25000. Credit history making it easier to qualify for a US.

Available to use for multiple projects. Address to help build your US. The HELOC rate is typically 080-140 higher than a comparable 5-year variable mortgage rate so there is a premium that you pay for all of these perks.

The maximum line amount or credit limit on your HELOC is based on how much equity you have in your home your creditworthiness your debt-to-income ratio and your combined loan to value ratio or CLTV. Home Equity Line of Credit HELOC Unlock your low rate on a HELOC 1 and have the funds you need to re-invent your kitchen pay for a wedding cover the cost of tuition or more. A Home Equity Line of Credit from FNB is a credit line that helps you access the equity in your home to provide a reusable source of financing to help meet your financial objectives.

Borrowers must meet program qualifications. With a HELOC1 you can use the equity youve built in your home for major purchases repairs or renovationsAsk your banker if you qualify for 100 Bank-paid closing costs2. Put Your Home Equity to Work.

If used correctly however it can decrease your total credit utilization rate and act as a positive indicator of good borrowing behaviour.

Home Equity Calculator Free Home Equity Loan Calculator For Excel

How To Use Home Equity Line Of Credit U S Bank

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

Home Equity Loan Calculator Which Home Equity Loan Is Right For You

How To Use Home Equity Line Of Credit U S Bank

Home Equity Loan Calculator By Creditunionsonline Com Calculate Home Equity Loan Payments

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Heloc Home Loans U S Bank

Home Equity Line Of Credit Heloc Rocket Mortgage

Tools Calculators Navy Federal Credit Union

Home Equity Line Of Credit Qualification Calculator

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Loans Home Loans U S Bank

How To Use Home Equity Line Of Credit U S Bank

Heloc Calculator